The Spotsylvania Board of Supervisors has worked for more than 10 years to destroy public education by defunding it. Both political parties see it. The Board can fix it in one easy move.

Last fall’s elections in Spotsylvania County were arguably among the most heated in our region. Parents and voters frustrated with a dysfunctional Tea Pary-led School Board overwhelmingly rejected their heavy-handed approach to running the public schools.

The last time voters in Spotsylvania were this worked up was, arguably, 2021. That was the year that conservatives overwhelmingly rejected the heavy-handed approach of the School Board that had been in control since 2019.

And in the wake of both elections, optimism that change was coming quickly gave way to frustration, as the Boards were unable to implement the kinds of immediate reforms that voters wanted.

Excuses abound for why change didn’t happen soon enough. But on one impediment to change, both Boards actually agreed.

Economics.

The refusal of Spotsylvania’s Board of Supervisors over the past decade to properly fund schools represents a crisis of priorities in the county.

It has little to do with politics, ideology, or school curricula. It has everything to do with what the county chooses to value. And for more than a decade, Spotsylvania has undervalued education.

Couple that with an antiquated state tax code that strips the ability of counties to take the steps they need to invest in education and other public goods, and one begins to understand that the political back-and-forth we have watched in Spotsylvania (book burnings one cycle, returning everything to the way it was in 2019 the next cycle) is a distraction from the real issue.

Pleading Poverty?

The Board of Supervisors in Spotsylvania County has year-in-and-year-out hued to a taxing philosophy that stresses keeping tax rates level, and low, for its residents. The philosophy is not without merit. Reflexively raising taxes every time a need for more money arises can quickly spiral out of control and do irreparable harm to those who can least afford to absorb an increase.

However, it’s Spotsylvania’s zest for low tax rates that has gotten out of control. Let’s consider just a few broad data points. From 2008 to 2023 the average tax rate increase in Spotsylvania County was less than 1% a year, far below annual Consumer Price Index adjustments. While taxpayers will see a substantial increase in real estate taxes this year, the Spotsylvania tax rate of $0.7343 remains dramatically lower than neighboring Stafford’s tax rate of $0.9067.

Were Stafford and Spotsylvania radically different counties, Spotsylvanians could reject the comparison. But in fact, the two counties share much in common — both are among the fastest-growing counties in Virginia, both have growing school populations and aging buildings, both attract workers who commute north for higher pay, and both have the recent memory of when the counties were primarily rural. Given the commonalities between Stafford and Spotsylvania, the $0.17 tax rate difference is shocking given the bipartisan agreement that the Spotsylvania school system is seriously underfunded.

Board of Supervisors member Chris Yakabouski told the Advance in April: “There was one thing [outgoing conservative Superintendent Mark Taylor and progressive School Board Chair Lorita Daniels] all had in common.” It wasn’t their ideology or politics, he continued, it was the realization that “the schools are underfunded.”

“The problems that we have are not going away,” he continued. “This unfortunately is the path we’ve been going down for the past 12 years. The issues haven’t gotten any smaller. One day we’re going to have to tackle them.”

One day is going to have to come soon. A look at Spotsylvania’s history with the real-estate tax shows the depths to which the county has gone to keep the real-estate tax suppressed.

And yet, despite the effort to keep the tax rate low, the amount of revenue that the county has been taking in is not just growing; in recent years, it has been surging.

So why hasn’t the school system been receiving the funding that it requires to function effectively?

As Yakabouski told the Advance in February, the Board of Supervisors for years has been robbing Peter (the school system) to pay Paul (first responders).

The county, he said, has significantly ramped up its fire and rescue system by taking on 24/7 coverage for professional firefighters, and filling gaps with volunteers when needed. He also notes that the county went to 24/7 advanced life support at every station.

Though a much-needed improvement, it came at a substantial cost.

“In the past [the money to pay for these upgrades] came out of the typical transfer that would have gone for schools,”

Few would argue that the upgrades in Spotsylvania to First Responders isn’t worth doing. However, funding schools is also important. And that means taxes in Spotsylvania County will most likely have to rise.

Can the county afford it?

To be sure, Stafford per capita is wealthier that Spotsylvania, but the county that bills itself as the “Crossroads of the Civil War” is enjoying a surge of its own in wealthier residents.

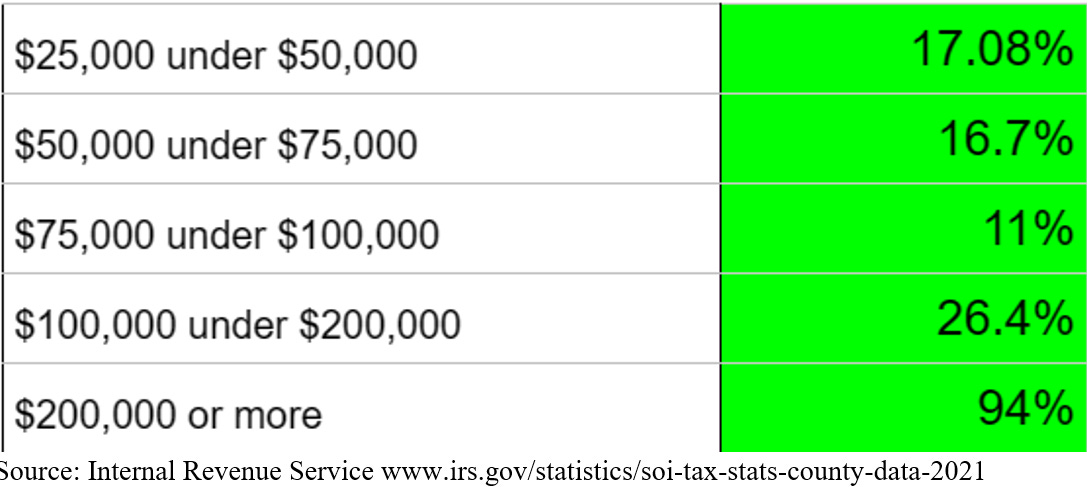

Comparing the number of tax filings in 2015 with those in 2021 — the last year for which the IRS publishes data — the county has seen a dramatic surge in the number of returns with more than $200,000 in income.

While those making less than $75,000 still constitute the lion’s share of residents, the bump in those earning more than $200,000 annually is the fastest-growing segment in the county. Some 27% of tax returns filed in Spotsylvania in 2021 were for incomes over $100,000.

Spotsylvania is attracting more-well-to-do people who can afford a higher tax rate, and who are more likely to demand that schools be improved to meet higher academic standards.

The problem? The income-tax data doesn’t tell the whole story. In particular, it masks the problems created by an antiquated tax system Virginia continues to suffer under.

Richmond – Again – Stands in the Way

Part of the challenge all fast-growing localities in Virginia face is generating revenue from an antiquated property tax system originally instituted in the 1600’s. In modern times, property taxes are extremely regressive and disproportionally harm individuals at the lower end of the income scale. Unlike the income tax, property taxes bear no relationship to one’s ability to pay.

In Virginia, localities receive approximately 70% of their local tax revenue from real estate and personal property taxes. These are the only taxes the General Assembly provides to localities that generate enough tax revenue to fund local services.

Making matter worse, Richmond doesn’t provide localities with the necessary tools to assist those at the lower end of the income scale struggling to pay bills. This leaves politicians to walk a tightrope between raising taxes enough to find vital services but not so much that they force people out of their homes.

Until the General Assembly allows localities to move beyond the current property tax system to a more progressive tax system or offers tools to provide tax relief to those in need, this tug of war between needs and funding will continue.

Another Solution

Right now, it is teachers and school employees who are going to pay the price for this financial negligence. Spotsylvania Public Schools is facing up to the prospect of potentially laying-off employees. The new health insurance package is also placing a heavier burden on teachers and their families.

This is all on top of the long-standing gap in pay between Spotsylvania and Stafford, also created by the Board of Supervisors’ unwillingness to responsibly fund the school system. (Compare the two counties’ pay scales on the Stafford and Spotsylvania websites. First-year teachers have comparable salaries. By year 10, however, teachers in Stafford are making nearly $7,000 more per year than their counterparts in Spotsylvania. And that gap persists throughs years 20 and 30.)

The necessary reforms to the state’s antiquated tax system will take time. Time the county does not have.

However, Spotsylvania has an opportunity right now to correct its habit of underfunding schools.

That solution is data centers.

A portion of the reliable stream of income that these centers will produce can be directed initially to dealing with the county’s aging school infrastructure. As we reported in March, the county has been forced to defer maintenance for years. Maintenance that the school system can no longer afford to put off.

Data center funds certainly can help cover that. According to Spotsylvania Board of Supervisor’s member Jacob Lane, the county will realize $13.8 million in average annual tax revenue for the county over a period of 15 years, beginning in 2025.

Beyond infrastructure costs, however, these data centers can also help cover the operating funds for salaries and more.

Critics caution that data centers’ tax payouts to counties is unstable. There’s a big infusion of cash up front, the argument goes, but then declining revenues as time goes by as the components in the centers ages and their tax value declines.

This, however, is not the case. While the components that drive the data centers do see their values decline — and the accompanying tax revenues associated with them — these components are replaced every four to five years.

In Loudoun County, that’s meant reliable big dollars for both the county and the school system.

Spotsylvania County now stands to reap the same benefits that Loudoun has benefited from for years. It’s a once-in-a-lifetime opportunity to redress the county’s historic underfunding of education.

Scott Mayausky of Stafford County assisted with the data research.

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit our website at the link that follows.

Support Award-winning, Locally Focused Journalism

The FXBG Advance cuts through the talking points to deliver both incisive and informative news about the issues, people, and organizations that daily affect your life. And we do it in a multi-partisan format that has no equal in this region. Over the past month, our reporting was:

$8 a month supports great journalism

- First to report Mary Washington Healthcare’s move to close Kid’s Station Daycare

- First to detail MWHC’s taking actions that undermine the viability of the Moss Free Clinic.

- First to detail and then expose the controversy surrounding the Riverbend High School swim team

- Providing the region’s best political coverage of the upcoming 7th District Congressional race.

For just $8 a month, you can help support top-flight journalism that puts people over policies.

Your contributions 100% support our journalists.

Help us as we continue to grow!