Let’s ask this dead horse about sales tax hikes on the working poor while giving $1.5 billion to wealthy developers in Potomac Yard.

House and Senate Democrats have already labeled Governor Younkin’s budget as tantamount to a slap in the face. Yet the Governor’s Budget is meeting an increasingly loud crescendo from fiscal conservatives who were neither consulted nor engaged by the Governor’s Mansion and are for the first time starting to announce their unhappiness with how they have been treated by staff.

Of course, no Virginia Republican is going to throw such a hard right that it threatens the possibility of the Governor’s Mansion falling into the hands of the party opposite. If there is one thing which galvanizes Republicans at present, it is the remote possibility of returning to the McAuliffe-Northam era. This may moot criticism of His Excellency for a time, but not forever.

Case in point is the critique from Steve Haner over at the Thomas Jefferson Institute for Public Policy (TJIPP):

The Republican governor and his staff also did little or no advance work before he made his other big announcements in December, two tax policy changes that he used as revenue assumptions for his proposed two-year budget. He wants to cut income tax rates across the board, but in partial compensation, he proposed to both raise the state sales and use tax rate and expand that tax to cover more digital services.

Case in point? No Republican is going to storm the Bastille in order to raise the sales tax to 6.2% — not when people are paying 20% more for a service on top of a 6% meals tax in some localities on top of an expected 15-25% tip.

Once again, the Rich Men North of Richmond just don’t get it.

This might make sense in the cubicles, but it is incredibly distant from kitchen table values who are still reeling from the Biden economy — and Youngkin voters who believed the man understood Virginia values are starting to learn a very different reality about his priorities (see: $1.5bn taxpayer-backed stadium investments)

The Tax Hike So Ugly No One Would Adopt It

To make matters more complicated, the elimination of the universally hated car tax — a promise made during the Gilmore era — complicates things for Virginia localities, who are reimbursed according to an arcane funding formula powered by Heideggerian AI and a few hamsters on a treadmill.

Tinkering with a $2.8bn funding pipeline at a time when many localities are staring down budget deficits is dangerous indeed. Insisting upon moving the tax burden away from income to sales taxes when both House and Senate Democrats are prioritizing a series of legislative initiatives — raising the minimum wage, gun control legislation, and childcare funding among others — has the potential to get silly quickly. You don’t have to be Sam Rayburn to figure out that Youngkin is now going to be dealing from a dead deck.

Worse still? No one — and I mean no one — outside of Youngkin inner circle seems to know what the endgame is:

If there is a white paper explaining the details or rationale behind the effort to shift the burden from income to consumption taxes, it has not surfaced. If the governor assembled a political coalition of stakeholders willing to join him in selling the idea to the public and to legislators, there is no sign of that either.

Youngkin’s more extensive tax cut package for the 2023 General Assembly also lacked a public sales pitch in the months before the session or an organized campaign of support from outside groups to pressure the Assembly. For the most part it failed. It is discouraging that no lessons were learned.

Meanwhile, the Commonwealth Institute for Fiscal Analysis — definitely left of center — heaped coals upon the heads of the apparatchiks:

While there are some worthy investments in the governor’s proposal, we should be using all available resources to make transformational investments in the building blocks of our communities like public schools. Instead, the governor is proposing harmful permanent tax cuts that would forfeit billions in shared resources, including cutting the top tax rate from 5.75% to 5.10%, giving generous tax cuts to high-income filers. A high-end lawyer with $2 million in income would have their income taxes go down by about $12,853 under this proposal.

Moreover — the use of Virginia’s cash reserves of $3.2bn to bridge the gap to the next biennial budget only creates an unstable environment for the next occupant of the Governor’s Mansion, relying on a quick economic recovery over the next two years.

Anyone willing to bet the mortgage on that?

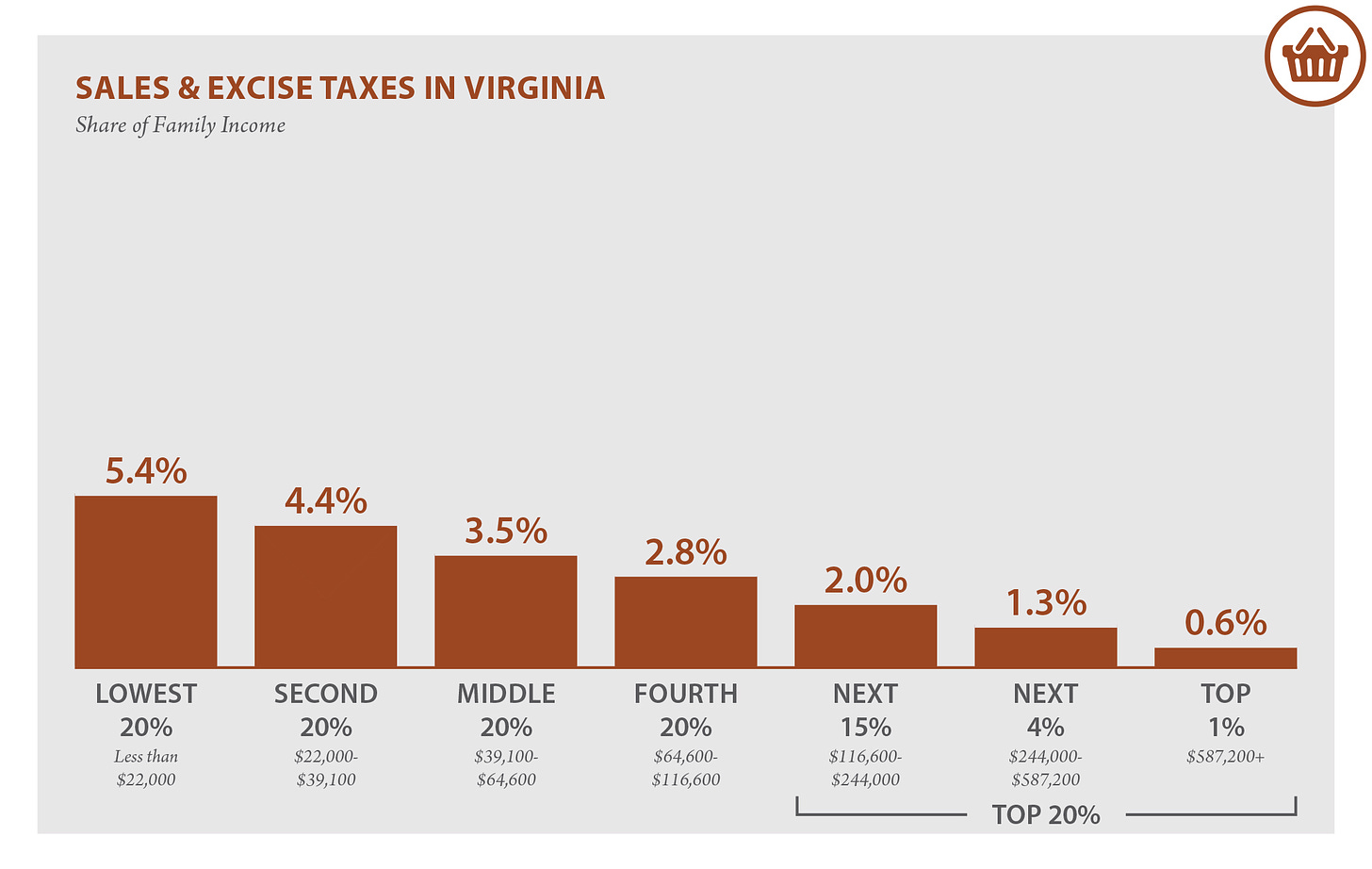

The wider complaint about Youngkin’s tax hike on working class families is that the budget disproportionately relies upon a sales tax increase — one that is regressive and impacts the working poor in a way income taxes do not:

From least regressive to most regressive, your tax options go as follows: corporate taxes, income taxes, personal property taxes, consumption taxes (or sin taxes — alcohol and cigarettes), and finally sales and excise taxes.

While there is some quibbling to be done — sales tax revenue proved to be more stable than income tax revenue during the Great Recession — the general rule of thumb is that property tax revenue is the most stable form of taxation followed by income and corporate taxes, sales taxes are notoriously susceptible to economic downturns — with the result being that income taxes are inevitably raised in order to meet funding gaps, and sales taxes never come back down to earth.

Virginians may hate the car tax, but at least cars — and data centers, O wise ones — depreciate in value over time. Grandma still needs milk and bread on a fixed income, and the increased cost of everything isn’t going to make her basic needs more affordable as a Virginian. Income being the surest measure of wealth and affordability, there is really no excusable reason to lighten the load on the well-to-do only to heap the responsibility of government onto those who most benefit from its programs.

Unless there is broad and meaningful spending reform to go along with the tax reform? Republicans will sit on their hands — and rightly so.

Virginia Isn’t Alone: Sales Taxes Are All the Rage

Of course, Nebraska is floating this experiment by attempting to trade a sales tax increase for a 40% reduction in personal property taxes — one that Americans for Prosperity Nebraska immediately attacked as a tax hike on working class families. In the past, the Heritage Foundation has been hostile to any movement towards sales taxes — specifically the internet.

Members of the House Freedom Caucus floated the idea of a national “fair tax” — air quotes used because it consisted of a 23% sales tax on everything to substitute for the present tax code. Sure — Americans could do their taxes on a postcard, but on the back of an eviction notice before they impound your vehicles (maybe).

Yet the idea of simplification without stratification seems shortsighted. Does Virginia need tax reform? Surely it does — one that encompasses a broad vision for education funding, linking land use to transportation dollars, and an increased pooling of resources toward planning district commissions (PDCs) to tackle regional opportunities.

Eliminating the car tax is a noteworthy effort, but let’s not pretend that it isn’t being used as a stalking horse for a massive tax hike on working class families. There is a damn good reason why conservative think tanks and thought leaders were locked out on this budget — and tax revolts are an honored Virginia past time indeed.

As for what Virginia Democrats will do? Extract concessions, of course. Youngkin gave Speaker Scott the baseball bat early and didn’t warn friends — a rookie move in Richmond. Here’s hoping the collegiality of the General Assembly — long slumbering yet perhaps stirring — can forge a better path amidst slim Democratic majorities.