by Adele Uphaus

MANAGING EDITOR AND CORRESPONDENT

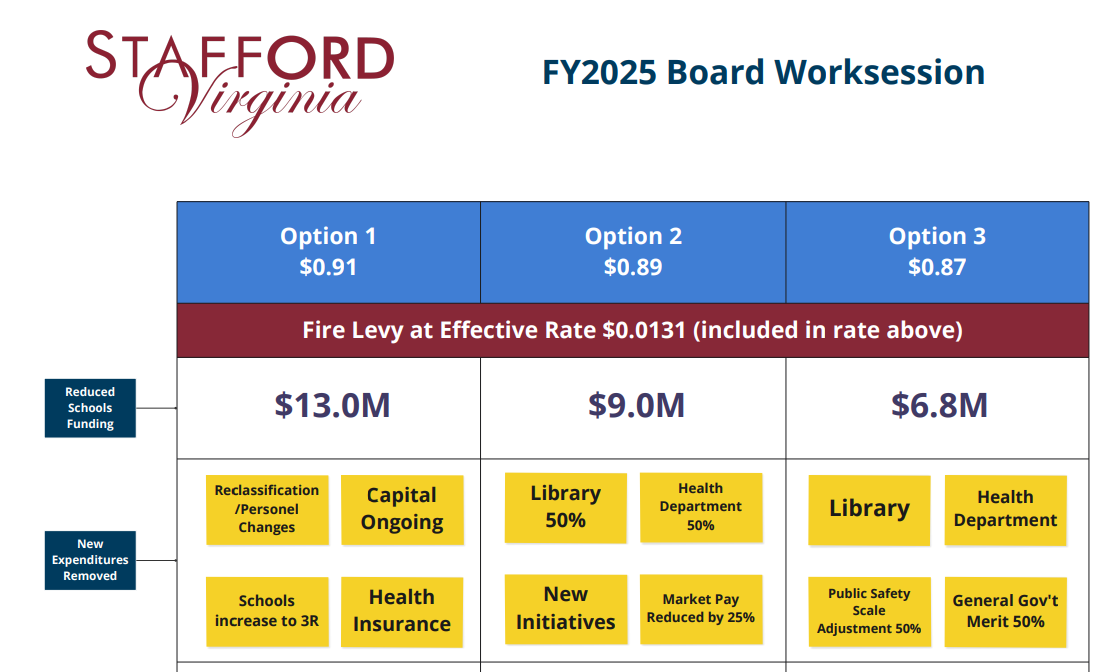

Stafford County Supervisors on Tuesday voted to advertise a real estate tax rate for calendar year 2025 of $0.91 cents per $100 of assessed value.

This rate includes a levy of $0.0131 for fire and rescue capital projects.

The tax rate is subject to a public hearing on March 19. The Board can lower the tax rate below what was advertised when it adopts a budget for fiscal year 2025 next month, but it cannot raise the rate without re-advertising and holding another public hearing.

The advertised rate is lower than the $0.94 rate proposed by outgoing County Administrator Randall Vosburg in his budget.

It will reduce the amount of revenue for the school division from $15 million—which would have fully funded the School Board’s approved budget—to $13 million, and will require the elimination of other expenditures, such as ongoing capital maintenance and new staff positions.

Supervisors approved the $0.91 advertised rate on a motion by Griffis-Widewater representative Tinesha Allen that was also supported by George Washington representative Deuntay Diggs, Aquia representative Monica Gary, Garrisonville representative Pamela Yeung, and Hartwood representative Darrell English.

Crystal Vanuch, Rock Hill representative, made a substitute motion to advertise a lower tax rate of $0.89, which would have reduced new funding for the schools to $9 million, because a lower rate “requires us to do that hard work” of making cuts.

Real estate was reassessed in the county this year and though the average assessed value increased by between 11% and 16%, Vanuch said there were 16,000 homes that increased in value over that average.

“I will be voting with those 16,000 residents today” to keep taxes low, Vanuch said.

Gary said “it’s not lost” on her that increased taxes can be a burden on some households, but that the proposed increase per month is “negligible for what we will be getting out of it in investing in our children and educators and support staff.”

Allen and Diggs also both said they are hesitant to set a lower advertised tax rate because they do not want to jeopardize funding for schools, especially funding that would provide pay increases to support staff, such as paraeducators, maintenance and custodial workers, food service staff, and administrative and clerical staff.

Also on Tuesday, supervisors voted to defer authorizing an April 2 public hearing on issuing general obligation bonds from the Virginia Public School Authority in the amount of $91 million to finance school construction projects.

County Budget Director Andrea Levy said the $91 million includes about $2 million to begin designing the rebuild of Drew Middle School, about $40 million each for construction of elementary schools 18 and 19, and about $2 million to continue work on high school 6.

Levy said if supervisors are “uncomfortable with the [school division’s capital improvement plan] and what might be in it, we can postpone [the public hearing] to early fall or even next spring” when the bonds are borrowed.

Yeung motioned to defer the public hearing on the bonds and was supported by Bohmke, Vanuch, and English. Allen, Diggs, and Gary voted against deferring.