By Adele Uphaus

MANAGING EDITOR AND CORRESPONDENT

Stafford County parent Joshua Mead stood before the Board of Supervisors yesterday evening and suggested that they hold their next work session on the ground in a hallway, instead of seated at a desk in a conference room.

“Or maybe you could hold these meetings in a trailer in a parking lot that doesn’t have access to running water or restrooms,” Mead said. “How supportive would you be of Stafford County Public Schools if you had to conduct business in the same manner that our students are forced to learn?”

Mead was one of at least a dozen county residents who asked supervisors to fully fund the school division during Tuesday’s public hearing on the budget and capital improvement plan for fiscal year 2025, which begins July 1.

Among the speakers were parents of students in the school division, employees of the school division, and county tax payers with no school division affiliation.

“I have nobody who is a student or employee of the schools,” said Don Grey. “l’m just a resident and taxpayer who wants to provide a good education for Stafford County students. I’m requesting that the Board of Supervisors set a tax rate which will do the following: ensure competitive salaries, build new schools in a timely fashion to keep up with population growth and minimize modulars, and maintain existing school facilities.”

Supervisors earlier this month voted to advertise a tax rate for calendar year 2024 of $0.91, which includes a real estate tax rate of $0.8969 per $100 of assessed value plus an additional fire levy of $0.0131.

The advertised rate is less than the $0.94 combined tax rate proposed by County Administrator Randall Vosburg in his budget, and will require supervisors to cut $5.4 million in expenditures.

The lower tax rate will also result in less new funding for the school division. Vosburg proposed $15 million in new money for division, which would have fully funded the School Board’s approved budget.

That budget would have provided a salary raise for the school division’s support staff – a raise which has already been pushed back for several years due to a lack of funding.

Speaker Molly Denham asked supervisors why they did not vote to advertise the tax rate recommended by the county administrator.

“[School division superintendent Thomas Taylor] has told you in multiple meetings that should you not fully fund the schools, the only option they have left is to cut into the personnel department, to include significant pay raises for over-worked staff,” Denham said. “The county administrator told you that 94 cents was the absolute lowest you could set the combined rate and still fund the schools. You chose not to advertise at that rate. You knowingly chose to cut much needed raises, effectively telling school staff that they aren’t the priority you claim they are. You will have to look at each individual here in green [the color school support staff are using to advocate for themselves] and tell them they are not enough of a priority to support a tax rate that your own staff told you was necessary.”

There were no speakers on Tuesday in support of lowering the real estate tax rate below $0.91.

The Board can adopt a lower tax rate than what has been advertised, but cannot adopt a higher rate without readvertising the new rate and holding another public hearing.

The Board did vote to readvertise a personal property vehicle tax rate of $5.89, 40 cents higher than the rate previously advertised.

Andrea Light, director of budget and finance, said the county is projecting $4 million in personal property tax revenue for next fiscal year to support “transportation and on-going general government needs.” In order to meet that projection based on updated information gathered by the Commissioner of the Revenue’s office regarding car values, the personal property tax rate needs to be raised over what was advertised.

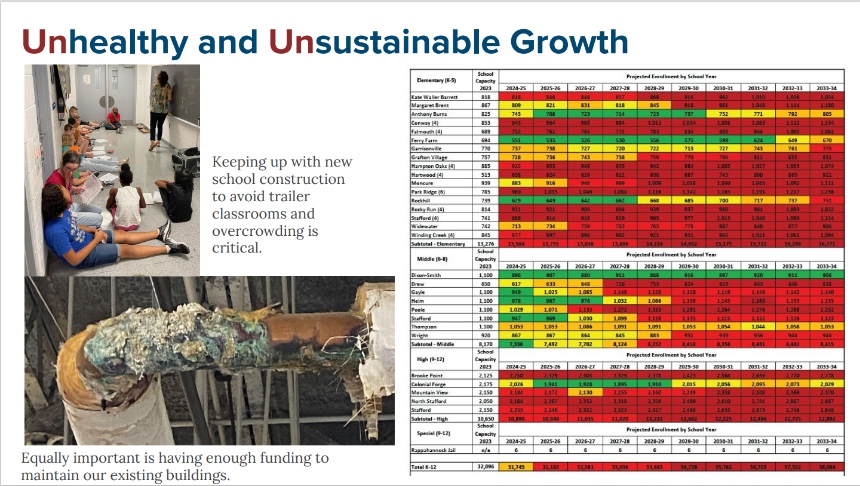

Prior to the regular meeting, the supervisors held a work session on the county’s capital improvement plan, which included a discussion of school division construction needs.

Supervisors approved funding for two new elementary schools to open in August of 2026 as part of the capital improvement plan for the current fiscal year. Elementary school 18 and high school 6 will be built together on a campus off U.S. 17 and Truslow Road in the Hartwood District, but the School Board and Board of Supervisors are in disagreement over where elementary school 19 should be located.

In this year’s capital improvement plan, the School Board is prioritizing rebuilds of Drew Middle School and the Rising Star Early Childhood Center, which are two of the oldest buildings in the division and are in deteriorating condition, to be completed in August of 2028.

But Light told supervisors at the work session that there is “not enough debt capacity to put those two schools together” and that one of the projects will need to be moved out several years.

Both boards are in agreement that delaying the rebuild of Drew is not an option. Meg Bohmke, Chair of the Board of Supervisors and representative for the Falmouth district, where Drew is located, said she receives emails “at least once every three days” about the “deplorable conditions” there.

Supervisors discussed different options for prioritizing Drew in light of funding constraints, including pushing elementary school 19 back to allow for the Drew and Rising Star projects to proceed jointly, but did not come to any decisions.

The Board is expected to adopt the budget for fiscal year 2025 on April 2.