Tax assessment spike in the county is high, but not out of line with increased property values.

by Martin Davis

EDITOR-IN-CHIEF

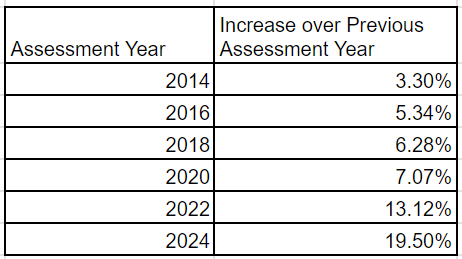

Last week, the Advance reported that real-estate assessments were up about 20% for residential properties, and 8% for commercial properties. How significant is that jump?

In an email exchange with Spotsylvania Commissioner of the Revenue Deborah Williams, the significance of that jump came into perspective.

According to Williams, real-estate assessments have grown year-over-year each assessment cycle since 2014, the first year for which the Advance requested information.

While the 6.38 percentage-point jump from 2022 to 2024 is jarring, it’s close to the 6.05 percentage-point jump from 2022 to 2024.

One significant reason for the jump is tied to “record low inventory of properties for sale,” according to Williams.

Low inventory tied to significant growth is greatly accelerating the value of existing property values.

With continued population growth projected for the near future, jumps like those seen the past two assessment cycles could well become the norm in the near future. According to the Cooper Weldon Center at the University of Virginia, Spotsylvania’s population is projected to grow from 140,032 in 2020 to 155,407 in 2030; 177,568 in 2040; and 202,386 in 2050.

While social media sites like NextDoor have seen several people complaining about the increases, Williams reports that the county is not receiving an unusually high number of complaints about the assessments.

In neighboring Stafford County, Commissioner of the Revenue Scott Mayouski reports that assessments jumped 13% this year. In 2022, however, the county realized a 23% increase.

Higher Assessments, Higher Taxes?

Higher assessments, however, do not necessarily mean higher taxes. In the past, the Spotsylvania Board of Supervisors have worked to offer an equalized tax rate, whereby the tax rate is set so that the revenue collected matches, or is close to, the revenue from the previous year.

That practice, however, has put stress on the school system, a fact made clear Tuesday evening when the School Board presented its budget for the 2024-2025 school year. It reveals a funding gap of some $46 million, not including funds for dealing with the repair needs of aging infrastructure.

The gap is caused by several factors, most notably the sharp rise in special education and English Language Learner students, who cost considerably more to educate. It’s also due, however, to the Board of Supervisors underfunding schools for too long.

As Board Member Chris Yakabouski noted on February 13:

the county has significantly ramped up its fire and rescue system by taking on 24/7 coverage for professional firefighters, and filling gaps with volunteers when needed. He also notes that the county went to 24/7 advanced life support at every station.

Though a much-needed improvement, it came at a substantial cost.

“In the past [the money to pay for these upgrades] came out of the typical transfer that would have gone for schools,” Yakabouski said. “And now the school system has told us over the past two Boards that we need more revenue. So either something has to be cut, or you increase the rate to cover the cost.”

The impact of this underfunding is being felt right now.

Nicole Cole noted during the School Board’s presentation to the Board of Supervisors on Tuesday that the school system is not able to deliver an education that is on par. In fact, she used the word “substandard.”

And acting superintendent Kelly Guempel said that a significant number of the district’s schools are in danger of not meeting accrediting standards.

While no one expects the county to raise taxes to cover a $46 million shortfall in the school budget, the county does need to make a serious effort to begin closing that gap. And that means setting a tax rate that will affect homeowners directly in terms of higher tax bills.

With the surge of population growth a given, failure to act now will mean more painful raises in the future if the county continues to put off funding critical services.