There has been a lot of recent discussion about the federal debt and deficit, and a lot of misinformation about those items. Every website I’ve seen says something like “the national debt is the accumulation of the annual deficits and surpluses.” From 1998 through 2001 we had surpluses, so the debt should have gone down in those years. Right?

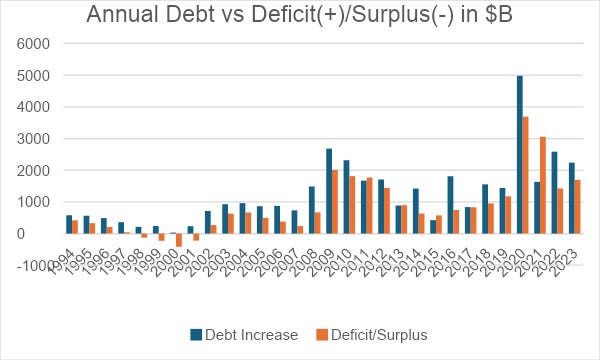

The chart below shows the annual increase in the debt (by fiscal year) compared to the reported annual deficit (shown as positive) or surplus (-). (All dollars in this article adjusted for inflation to 2023 dollars. Source information at end of article.)

With a few exceptions, the annual debt increase has been larger than the deficit. (Even with a $417B surplus in FY2000, the debt still increased by $32B.) So, how is this happening?

Three of the reasons causing the differences are:

- The annual surplus/deficit calculations include trust fund income and expenses.

- Certain expenditures can be designated “off-budget” (e.g. Iraq War). So, this spending does not affect the deficit, only the debt.

- Very large multi-year expenditures (e.g. 2008 real estate crisis; COVID-19) can be spent in different years (impacts debt) than the years they appear in the budget (impacts deficit).

Including trust fund income/expenses historically caused the deficit to be lower than it would have been. (I know you’re shocked that Congress did something that made them look better.) This is because any net income/expense of certain trust funds does not affect the total debt, only the split between the public and government held debt. This is true for trust funds that have a separate funding stream (e.g. Social Security Trust Funds, Medicare Hospital Insurance Trust Fund).

For example, if a Social Security fund had a $100 billion surplus, that trust fund would purchase $100 billion of government bonds, shifting $100 billion of public debt to government debt, but not changing the total debt. The trust funds had a surplus of over $400 billion in 2000, and that is how a deficit of $32 billion turned into a $417 billion surplus.

Medicare has two Trust Funds: Hospital Insurance (HI) and Supplementary Medical Insurance (SMI). The HI trust is mainly funded by the Payroll Tax, and pays for Medicare Part A and the hospital portion of Part C.

The SMI trust is mainly funded by participant premiums and payments from the federal government, and pays for Medicare Parts B, D and the remainder of Part C. Only the federal contributions to the SMI trust affect the debt, not its overall spending.

Social Security and Medicare now have growing deficits, so we will soon start to see deficits larger than the debt increase.

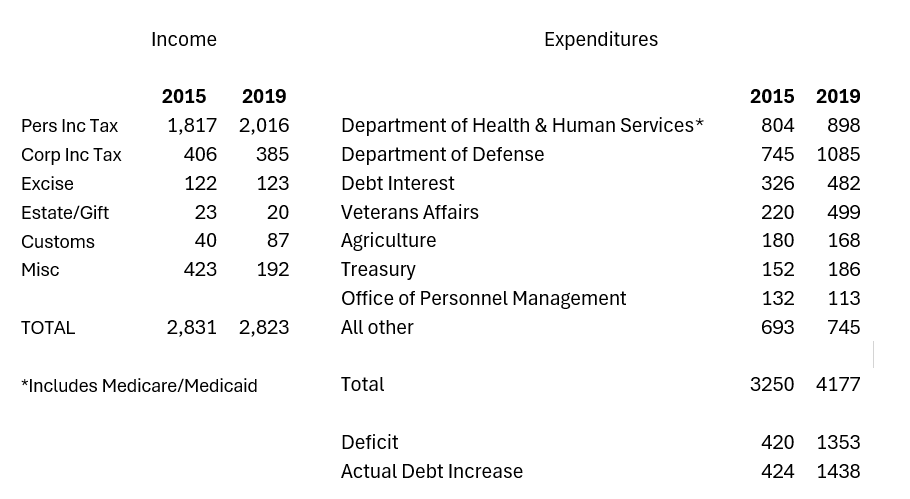

I have not found a report which details the income/expenses that cause the debt increase. I have attempted to make one for FY2019 (the year before COVID-19) and the most recent year with the lowest debt increase (2015).

This is close, but not 100% accurate because it still includes income/expenditures from some trust funds. The 2023 debt increase was $2,238 billion and the 2024 increase is on track to be around that number.

All COVID-19 funding expires in 2024, so hopefully the 2025 increase will be smaller. But making any progress in reducing the debt is a difficult task. I believe most people want to start solving the debt problem, but it would also be hard for a candidate who promises to raise your taxes and cut your benefits to win an election. I believe that Congress should establish one or more permanent Commissions to work on reducing the debt and ensuring all Trust Funds are solvent for several decades and agree to vote on their recommendations.

Data Notes: Debt data from US Treasury; inflation data from Investopedia; annual deficit/surplus data from Congressional Budget Office. Debt data income and expenditures from the Financial Report of the United States Government FY2015 and FY2019.

Correction

Yesterday’s story about the data center panel in Stafford County incorrectly identified the event as a “debate” in the headline. That has been corrected.

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit our website at the link that follows.

Support Award-winning, Locally Focused Journalism

The FXBG Advance cuts through the talking points to deliver both incisive and informative news about the issues, people, and organizations that daily affect your life. And we do it in a multi-partisan format that has no equal in this region. Over the past month, our reporting was:

$8 a month supports great journalism

- First to report on a Spotsylvania School teacher arrested for bringing drugs onto campus.

- First to report on new facility fees leveled by MWHC on patient bills.

- First to detail controversial traffic numbers submitted by Stafford staff on the Buc-ee’s project

- Provided extensive coverage of the cellphone bans that are sweeping local school districts.

- And so much more, like Clay Jones, Drew Gallagher, Hank Silverberg, and more.

For just $8 a month, you can help support top-flight journalism that puts people over policies.

Your contributions 100% support our journalists.

Help us as we continue to grow!

Support FXBG Advance for $8 a month